Decoding Australian Hybrids: Episode 3 – A Global Market Context

We are pleased to share the third video in our four-part series on Hybrid Securities, where members of the Bentham Asset Management investment team provide insights into the evolving hybrid […]

Decoding Australian Hybrids: Episode 2 – A Historical Perspective

We are pleased to share the second video in our four-part series on hybrid securities, where members of the Bentham Asset Management investment team explore the history, structure, and evolving […]

Decoding Australian Hybrids: Episode 1 – The Regulatory Shift Explained

We are pleased to introduce the first video of our four-part video series on hybrid securities, where members of the Bentham Asset Management investment team provide insights into the history of hybrids, structural considerations, alternative options and the associated risks and characteristics.

Bentham AU Q4 2024 Webinar: 2024 – A Rates Odyssey

Is Now the Time for Fixed Interest? An Asset Allocation Webinar

In 2021, interest rates went on a fantastical journey, leaving investors feeling like Dorothy in a strange new land. But with rates rising like a hot air balloon, we’re transitioning […]

Market Value & Liquidity

Fund structure plays an important part in the performance of credit funds. A well-structured fund supports pricing transparency, liquidity and fairness for unitholders. In this paper, Richard Quin outlines the […]

The Case for Investing in Global Credit

Global credit can be a useful

diversifying asset class for Australian

investors. It can offer higher income

than cash, with less risk than shares,

while bringing diversification benefits that can reduce overall portfolio risk.

Bentham Syndicated Loan Primer

Syndicated loans have developed

into an institutionally accepted asset

class because of their competitive

absolute returns and strong risk adjusted returns. When investing

in Syndicated Loans it is important

to consider managers that offer

diversification, as well as access

to new issues and hedging for

AUD investors.

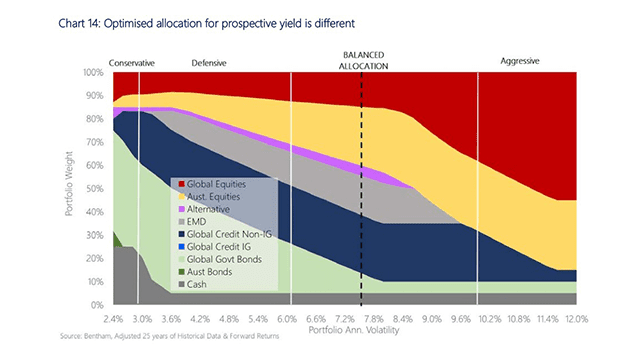

Asset Allocation in a Zero Interest Rate World

The current low level of interest rates provides investors with a very low starting point for forecasting future market returns.

This paper considers the role for alternative asset allocations in a 60/40 balanced portfolio in different economic scenarios over the medium term.